The new stablecoin regulations take effect in HK — how can Sumsub help businesses seize the compliance advantage?

Stablecoins are becoming the focus of global virtual assets and fintech sectors, with Hong Kong standing at the forefront of this wave.

Beyond regulatory policy advancement, numerous companies in the market have already begun active deployment: local payment institutions are submitting stablecoin pilot programs, major Chinese fintech companies are reportedly exploring the issuance of Hong Kong Dollar or offshore RMB stablecoins in Hong Kong, while some licensed virtual asset trading platforms are preemptively building compliance capabilities to seize future market opportunities.

With the Stablecoins Ordinance officially taking effect on August 1, 2025, Hong Kong has not only established a statutory regulatory framework for stablecoins but also clarified their important position as payment tools and financial infrastructure. In this new competition, “compliance” will become the key threshold for successful stablecoin implementation.

Development Timeline of Hong Kong’s Stablecoin Policy

Hong Kong’s focus on stablecoins was not achieved overnight, but through gradual regulatory exploration.

- As early as 2022, the Hong Kong Monetary Authority (HKMA) published the Discussion Paper on Crypto-assets and Stablecoins, pointing out potential risks from stablecoins including opaque reserves, uncontrolled cross-border capital flows, and money laundering and terrorist financing risks.

- Between 2023-2024, Hong Kong further proposed that stablecoins must operate under a licensing system, requiring safe reserve assets, transparent governance structures, and AML/CFT anti-money laundering compliance measures.

- Finally, in May 2025, Hong Kong’s Legislative Council passed the Stablecoins Ordinance, establishing a statutory stablecoin issuance business licensing system.

- In July of the same year, HKMA released detailed implementation rules covering KYC/KYB, AML, Travel Rule, risk management and continuous disclosure requirements, and stated at a press conference: The first batch of stablecoin licenses is expected to be issued in early 2026.

It can be seen that Hong Kong has chosen a path of “establishing rules first, then releasing business,” creating an ecosystem for stablecoins that balances innovation with compliance, also gaining first-mover advantage in global virtual asset competition.

Market and Compliance Challenges: The Greatest Challenge for Stablecoin Implementation

The core value of stablecoins lies in cross-border payments, retail settlements, and trade finance, but this also makes them more likely to become tools for money laundering, underground currency exchange, and sanctions evasion. Compared to traditional virtual assets, stablecoins are closely pegged to fiat currencies, making compliance more challenging.

As M Sivakumar, APAC Legal & Regulatory Affairs Director at Sumsub, pointed out in an interview with Hong Kong media “Hong Kong Economic Journal”:

“Stablecoins have enormous application potential, capable of improving cross-chain capital flow efficiency and supporting more flexible payment and settlement models. However, at the same time, anonymous non-custodial or self-custodial wallets may also bring risks such as layering and high-speed money laundering. Financial institutions must adopt strict due diligence, using methods such as real-time wallet risk scoring and behavioral analysis to detect wallets related to mixers, dark web markets, or sanctioned addresses before transaction execution, thereby effectively reducing risks.”

He also reminded that cross-border transfers must strictly comply with FATF Travel Rule, meeting regulatory requirements through automated data transmission and transaction screening. This is not only a hard threshold under Hong Kong’s stablecoin licensing system but also key to whether enterprises can operate legally in global markets.

On the other hand, privacy and “decentralization” are also core issues of external concern. Hong Kong media “Sing Tao Daily” pointed out that every stablecoin transaction is recorded on public blockchains. Although it doesn’t directly show users’ real identities, once wallet addresses are linked to personal identities, privacy risks may arise. Meanwhile, whether regulated stablecoins deviate from the “decentralization” concept has also become a hot topic of discussion.**

To this, M Sivakumar emphasized:”Regulated stablecoins represent a ‘hybrid model’ that can leverage operational efficiency from decentralized infrastructure while building market trust and stability through regulatory compliance.”

In other words, the future of stablecoins lies not in “absolute decentralization” but in finding balance between transparency, compliance, and efficiency. Combined with clear requirements in HKMA’s “Implementation Rules for Stablecoin Regulatory System,” stablecoin issuers and related service providers must:

- Conduct user and business identity verification (KYC/KYB) and perform continuous due diligence;

- Establish real-time transaction monitoring and risk management systems to identify money mule networks and abnormal transaction chains;

- Comply with FATF Travel Rule requirements, transmitting necessary identity and transaction data in cross-border transfers;

- Regularly conduct risk reviews and submit suspicious transaction reports (STRs) to regulatory authorities, maintaining continuous compliance.

How Sumsub Assists Stablecoin Ecosystem Compliance

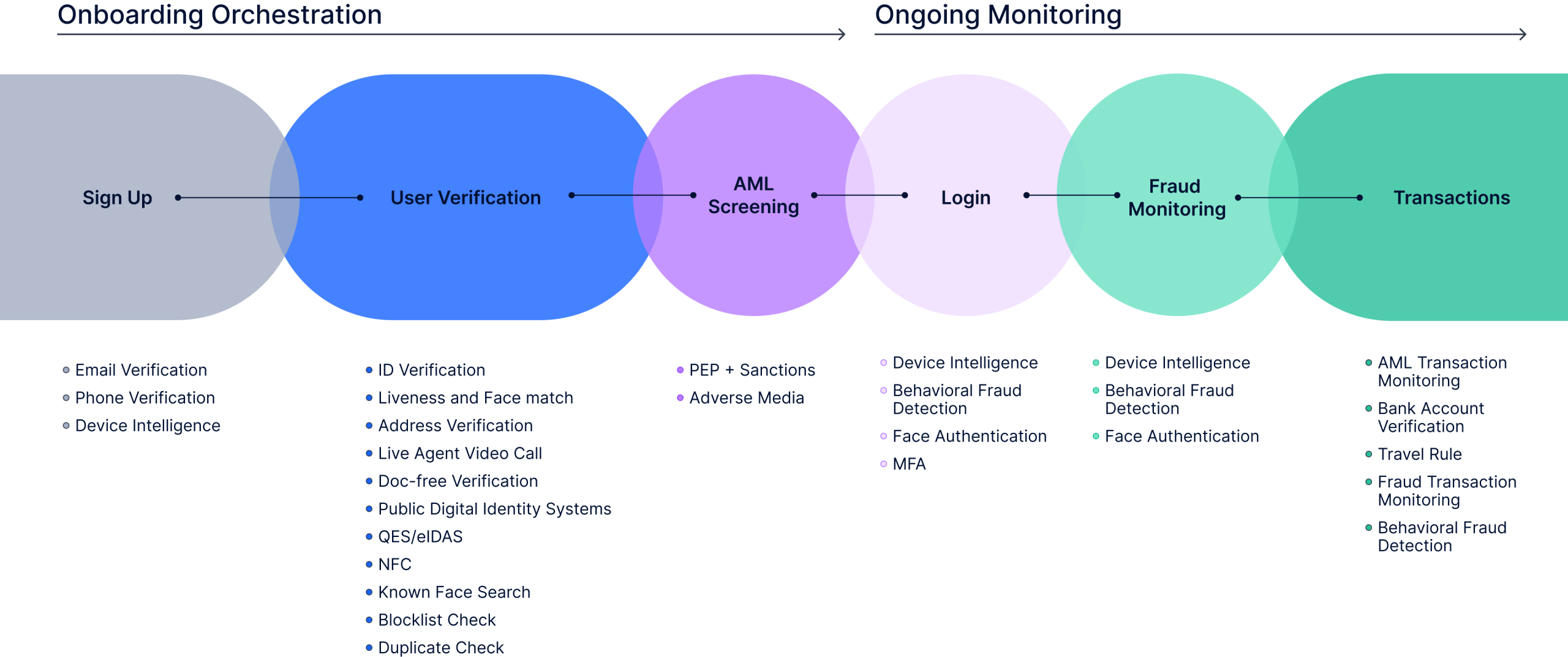

As a global leading compliance and verification solution provider, Sumsub has provided full-chain compliance capabilities for virtual asset exchanges, payment companies, and fintech platforms, highly aligned with Hong Kong’s new stablecoin policy.

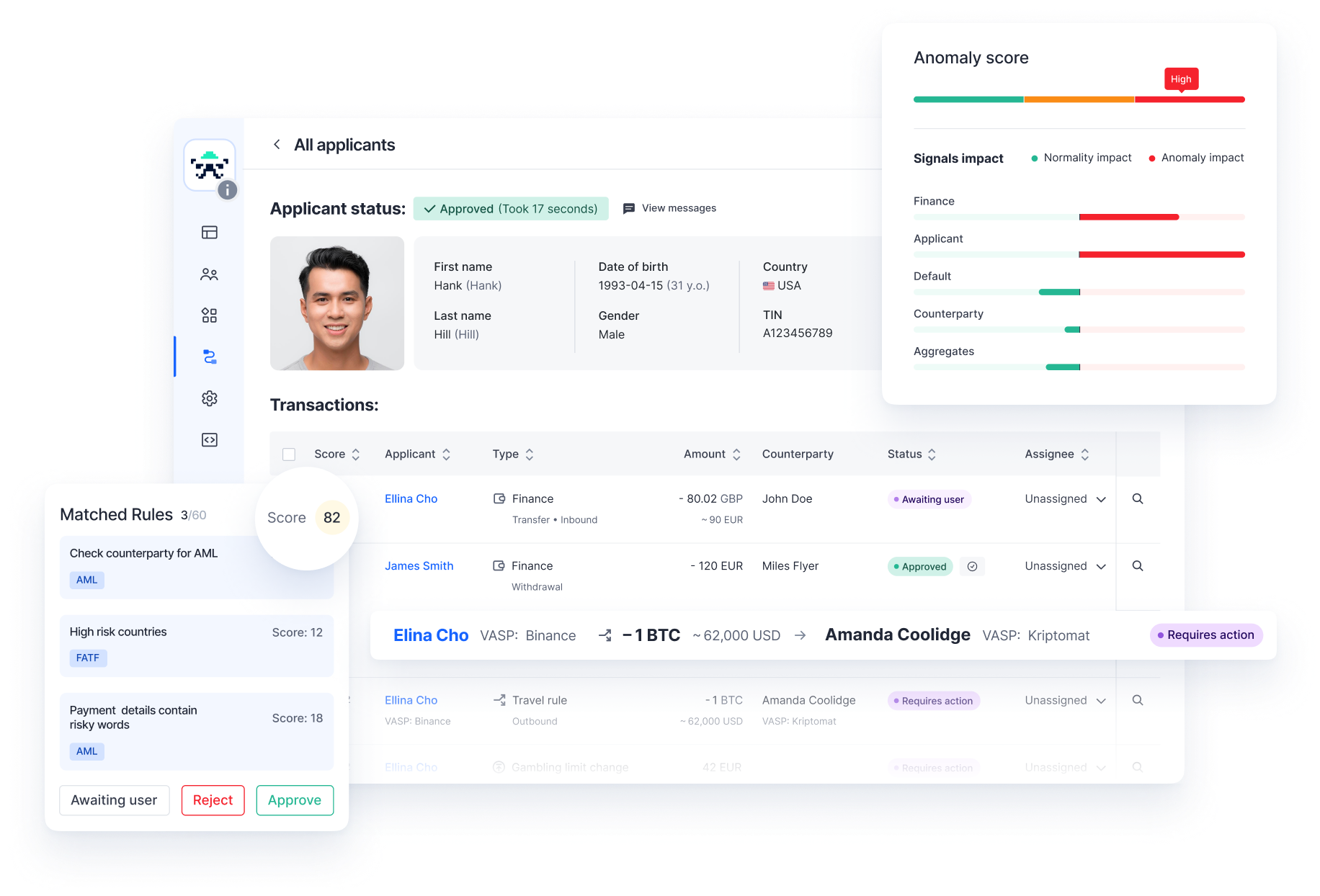

#1 Global KYC/KYB Identity Verification

Sumsub supports 220+ countries and regions, capable of processing 14,000+ identity documents and multilingual verification processes. Combined with liveness detection, biometric recognition, and database comparison, it helps stablecoin companies quickly identify user and business identities, reducing risks of fraudulent account opening and fraud. This directly corresponds to Hong Kong licensing system’s strict requirement for “traceable real identity.”

Image source: Sumsub

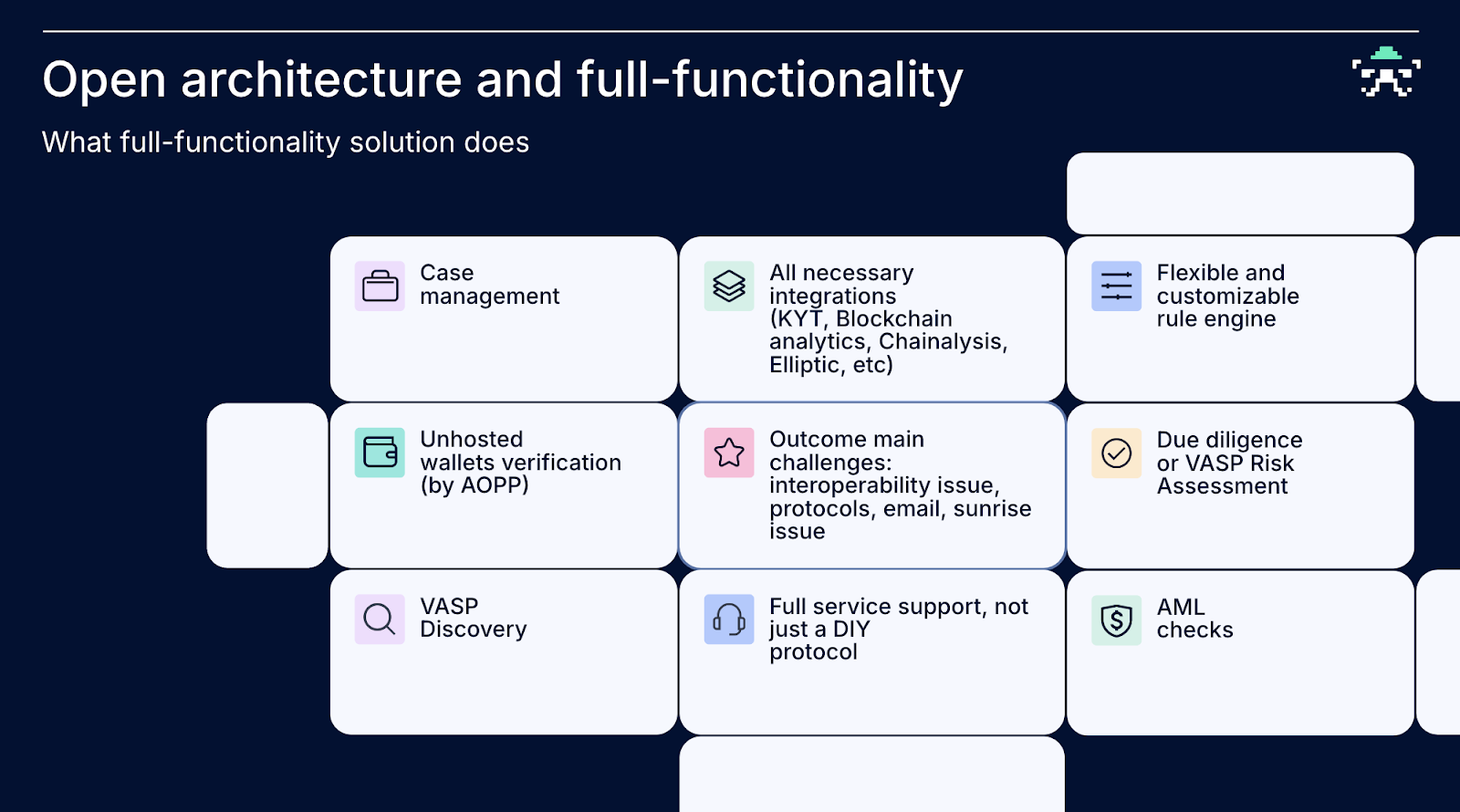

#2 Travel Rule and Cross-border Compliance Interoperability

Sumsub’s Travel Rule Hub has connected to 1800+ VASP networks and supports multiple mainstream protocols including TRP, Sumsub Protocol, GTR, CODE, Sygna, while equipped with email notification tools to ensure smooth information transmission even when counterparty VASPs use incompatible protocols.

This means that through multi-protocol compatibility, Sumsub enables stablecoins to seamlessly carry identity and transaction information during cross-border flows, automatically attaching “identity tags” and “transaction descriptions” like international remittances, thereby meeting FATF international compliance requirements and satisfying Hong Kong’s latest regulatory standards for anti-money laundering and counter-terrorism financing. For Hong Kong’s future cross-border payments and stablecoin clearing, this capability is indispensable compliance infrastructure.

Image source: Sumsub

#3 Risk Monitoring and Continuous Compliance

Sumsub has built-in AML monitoring and list screening (covering global sanctions lists, PEP, Adverse Media), combined with AI risk engines, transaction behavioral analysis, and device fingerprinting technology, capable of real-time identification of money mule networks, abnormal chains, or suspicious transactions. The platform also supports automatic STR (suspicious transaction report) generation, helping stablecoin service providers directly interface with Hong Kong and global regulatory requirements.

Image source: Sumsub

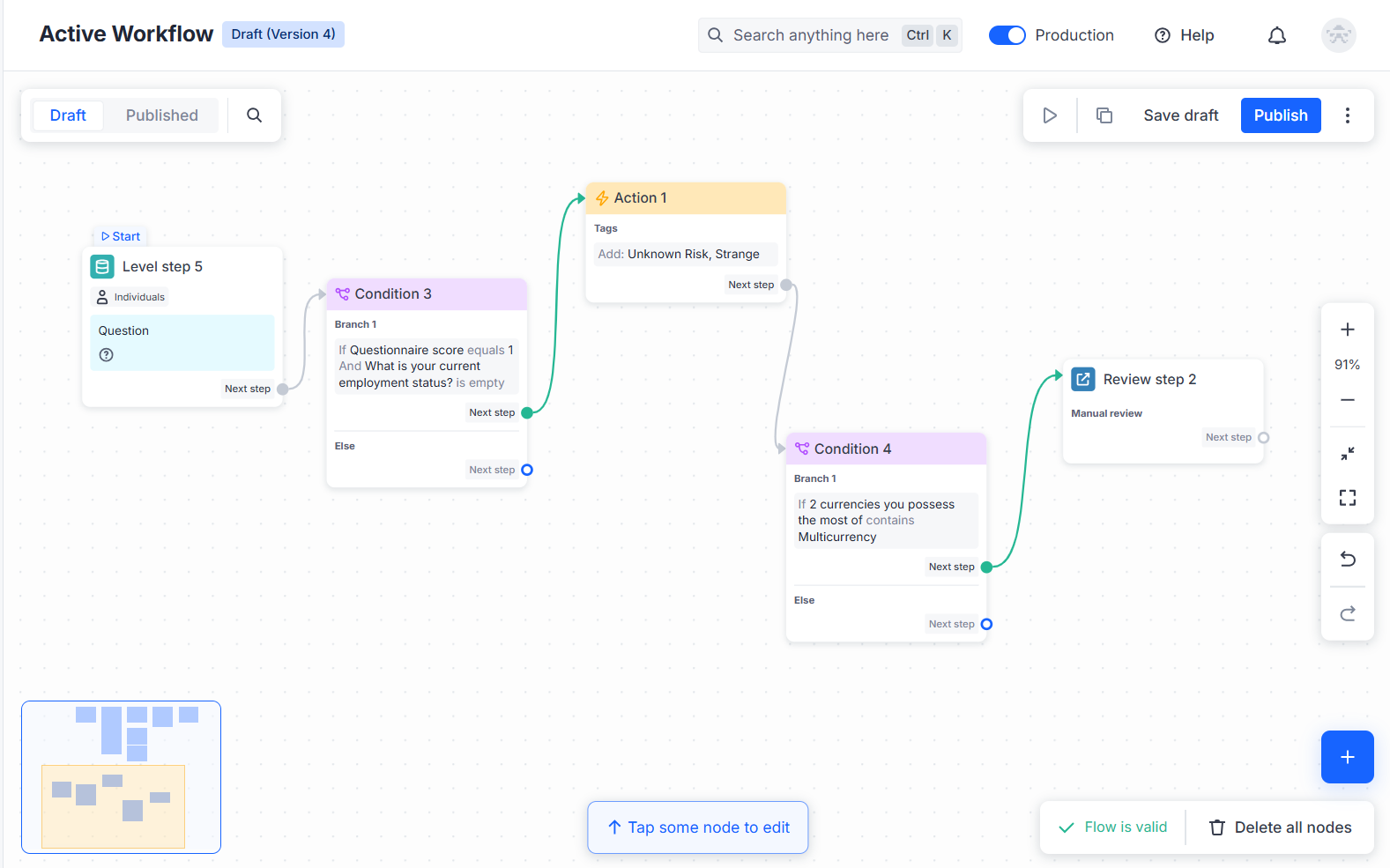

#4 Scalable Integrated Compliance Platform

Beyond identity verification and transaction monitoring, Sumsub also provides configurable onboarding flow tools (Onboarding Flow Builder), customizable risk scoring rules, and KYB penetrative due diligence for enterprises (Ultimate Beneficial Owner verification). This means enterprises don’t need to piece together multiple suppliers but can meet stablecoin full lifecycle compliance requirements through one unified platform.

Image source: Sumsub

Through these capabilities, Sumsub not only helps enterprises quickly “pass licensing thresholds” but also helps build long-term solid compliance moats in Hong Kong, laying a secure foundation for stablecoin applications in cross-border payments, retail finance, and trade finance scenarios.

👉 To learn more about platform capabilities, please register for the webinar held on August 13 (next Wednesday) through DKM expert demonstrations and explanations, experiencing up-close Sumsub’s innovative applications and operational processes in KYC, AML, cross-border anti-fraud, and virtual asset compliance scenarios.

International Perspective: Differences Between HK, SG, and EU MiCA

It’s worth noting that Hong Kong’s stablecoin regulatory path has both similarities and differences with major markets like Singapore and the EU.

– In Singapore, the Monetary Authority of Singapore (MAS) proposed a stablecoin regulatory framework in 2022 and released final rules in 2023, requiring single-currency stablecoins (such as those pegged to USD or SGD) to have 100% high-liquidity reserves, clear redemption mechanisms, and strict capital requirements. This is highly consistent with Hong Kong’s emphasis on “reserve transparency + AML compliance” requirements, but Singapore completed implementation earlier.

– In the EU, MiCA (Markets in Crypto-Assets Regulation) which officially took effect in 2024 established unified EU-wide rules for stablecoins (especially “Electronic Money Tokens” EMTs and “Asset-Referenced Tokens” ARTs), covering licensing, capital, transparency, and consumer protection requirements. This makes the EU currently the most systematized stablecoin regulatory market globally.

– In comparison, Hong Kong’s advantage lies in backing from the Chinese market, gradual policy tightening pace, and dual linkage of financial infrastructure with virtual asset ecosystems. It can be said that Hong Kong hopes to find a “flexible but constrained” regulatory balance path between Singapore’s “first implementation” and the EU’s “systematic governance.”

This means enterprises issuing or operating stablecoins in Hong Kong need to balance local compliance requirements while drawing from Singapore and EU standards to achieve cross-border compatibility and broader market expansion in the future.

Outlook: Compliance as Core Driving Force for Stablecoin Development

It’s expected that by 2026, Hong Kong will welcome the issuance of its first batch of legal stablecoins. This will promote the development of digital payments, cross-border settlements, and financial innovation, potentially becoming an important breakthrough for Hong Kong to reshape its international financial competitiveness. With the implementation of the Stablecoins Ordinance, Hong Kong’s stablecoin ecosystem will move toward a clearer, more mature regulatory framework.

Sumsub APAC Legal & Regulatory Affairs Director M Sivakumar also emphasized:”As stablecoins become increasingly mature, their application scenarios have expanded to more industries, no longer limited to virtual asset trading platforms. Different industries should deploy compliance infrastructure early, focusing on compliance risks and regulatory requirements including identity verification, transaction monitoring, and AI fraud, achieving faster and lower-cost capital flows through stablecoins.”

For enterprises, choosing Sumsub as a compliance partner is not only a necessary condition for meeting policies but also a strategic choice for winning the future.

As Sumsub’s important partner in the Asia-Pacific region, DKM is also helping enterprises in Hong Kong and the region better achieve compliance implementation. From compliance solution integration, localized operations to industry practice sharing, DKM will continue to work with Sumsub to build compliance bridges that meet both international standards and local environments for enterprises.

Thus, enterprises can not only rely on Sumsub’s global technology platform to meet the strictest regulatory requirements but also accelerate compliance implementation and business expansion through DKM’s local support, jointly seizing major opportunities brought by Hong Kong’s new stablecoin policy.

👉 To learn more about platform capabilities, please register for the webinar held on August 13 (Wednesday), experiencing up-close Sumsub’s innovative applications and operational processes in KYC, AML, cross-border anti-fraud, and virtual asset compliance scenarios through DKM expert demonstrations and explanations.

References

- HKMA. Discussion Paper on Crypto-assets and Stablecoins (2022)

- HKMA. Press Release on Stablecoin Regulatory Regime (2025-07-29)

- MAS. Requirements for Stablecoin Issuers (2023)

- European Parliament. Markets in Crypto-Assets (MiCA) Regulation (2023)

- Reuters. Hong Kong passes stablecoin bill, one step closer to issuance (2025-05-21)

- Reuters. First Hong Kong stablecoin licences may be issued early next year, HKMA says (2025-07-29)

- Reuters. China’s tech giants lobby for offshore yuan stablecoin, sources say (2025-07-03)

- Hong Kong Economic Journal. Sumsub: Stablecoins Hold Great Potential, But Financial Institutions Must Guard Against AML Risks (2025-07-29)

- Sing Tao Daily. Are Stablecoins’ Public Ledgers a Threat to Privacy? Debate Over Decentralization Under Supervision (2025-07-22)

- Infocast / 匯港通訊. Sumsub: As Stablecoins Mature, Their Applications Expand Across Industries (2025-07-29)